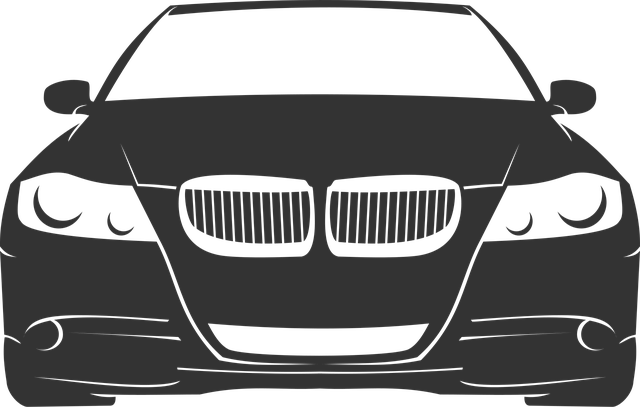

Car title loans Pampa TX offer quick cash using your vehicle as collateral, with flexible terms and swift approval, ideal for emergencies or substantial funding needs like Semi Truck Loans. Individuals 18+ with a valid ID and clear vehicle titles can apply, regardless of credit history. Repayment involves structured payments, with lenders offering flexible options and valuing your vehicle to determine loan amount and terms; timely payments protect your credit score.

Looking to protect yourself financially in Pampa, Texas? Car title loans could be an option. This article guides you through understanding car title loans in Pampa TX, assessing your eligibility, and securely repaying your loan. Car title loans Pampa TX offer a unique way to access cash using your vehicle’s title as collateral. By the end, you’ll have the knowledge to make informed decisions about this short-term financing solution.

- Understanding Car Title Loans Pampa TX

- Eligibility Criteria for Loan Application

- Repaying Your Car Title Loan Securely

Understanding Car Title Loans Pampa TX

Car title loans Pampa TX are a type of secured loan where borrowers use their vehicle’s title as collateral. This loan option is designed for individuals who need quick access to cash and have a clear car title in their name. Unlike traditional bank loans, Car title loans Pampa TX offer flexible payments, making them an attractive choice for those facing financial emergencies or unexpected expenses. The process typically involves a simple application, where lenders assess the value of the vehicle and its condition to determine loan approval amounts.

Once approved, borrowers can receive funds within a short period, providing relief during challenging times. Car title loans Pampa TX are particularly useful for people who own their vehicles outright, as it allows them to leverage their asset’s equity. This alternative financing method is especially beneficial for those seeking Semi Truck Loans or requiring more substantial funding but may not have excellent credit history, as lenders often focus on the vehicle’s value rather than personal credit scores.

Eligibility Criteria for Loan Application

When considering Car Title Loans Pampa TX, understanding the eligibility criteria is a crucial first step. Lenders typically require that borrowers are at least 18 years old and have a valid government-issued ID to apply. Additionally, having a clear vehicle ownership title is essential as it serves as collateral for the loan. This means there should be no liens or outstanding loans on your vehicle.

While Car Title Loans Pampa TX can be an option for those with bad credit, lenders may conduct a credit check to assess repayment ability. However, this doesn’t necessarily disqualify individuals; it allows lenders to determine the terms and interest rates suitable for each borrower’s financial situation. As long as you have the required documents and meet the basic criteria, you can increase your chances of securing funding for your needs.

Repaying Your Car Title Loan Securely

When it comes to repaying your car title loan securely in Pampa TX, it’s all about adhering to a structured plan and staying organized. The process typically involves making consistent payments as agreed upon with your lender. Most lenders offer flexible repayment options that align with your budget, such as automatic payments through direct deposit, ensuring you never miss a deadline.

Prior to taking out a car title loan, it’s crucial to have an accurate understanding of your vehicle’s valuation, which directly impacts the loan amount and terms. The Quick Funding feature offered by many lenders in Pampa TX streamlines this process, allowing you to access funds swiftly while ensuring you have a clear path for repayment. Remember, timely payments not only protect your credit score but also demonstrate responsible borrowing practices.

Car title loans Pampa TX can be a valuable tool for those in need of quick cash. By understanding the process, meeting eligibility criteria, and repaying the loan responsibly, you can ensure a secure borrowing experience. Remember, transparency and timely repayment are key to avoiding potential pitfalls associated with such loans. This knowledge will empower you to make informed decisions regarding your financial future.